Here is my monthly networth update. We're now worth $544,650.44.

That's a 0.3% improvement over last month, however, when considering the significant new expenses and outlays related to the purchase and move into our new house, it's much better than expected. I had actually planned on a networth decline of between $4,000 - $8,000 versus an increase of $1600.

I've also updated my networth at pfblogs.org. They really need to improve the chart, but it is better than nothing.

Key factors regarding this month's networth changes were as follows:

- purchase of new house

- packing expenses

- moving expenses

- some furnishing expenses

- window treatments

- some decorating

We were able to defer some furniture and decorating expenses for the new house, primarily due to:

- too busy unpacking

- shocked to learn that reupholstering our favorite love seat would cost $800

- too busy to decide what new furniture to buy

- unsure how much to invest in new furniture and decorations if we move within another year

I am hoping we can cashflow any additional decorations, new furniture or improvements. This may result in decreased monthly savings, but hopefully not have a negative impact on networth. Overall what we spend on the house will retard networth growth (outside of investment performance) until I start earning more money, which I hope to happen circa August.

A short term networth increase may come this month, if my wife's company does well enough to distribute a profit share. They have been investing in capacity improvements, so I think it might not happen for a while, though I would be pleasantly suprised.

I'll also have continuing education expenses hit us this month for about $3k. Not fun, but important for the future.

We will have family visit us in June. I expect it will be quite expensive to host them, however, we're considering it a reverse vacation and will spend money on hosting them as if we were spending it on visiting them. I would like to keep the costs under $4000, but it could go up to $6000. It will be a heavy hit.

Our retirement investments appreciated at 1.5% this month - almost entirely in Schwab's 2040 lifecycle product (SWERX). That's an 18% annualized rate, so I'm pleased with the results for that account.Our brokerage accounts, which are invested in diversified ETF's increased 2.9%, which is an annualized 35%, I'm quite pleased with that. It's not the staggering 8% or more of some momentum investors, but it's doing well. I've outlined my ETF investment strategy in an earlier post. I have not yet rebalanced and I am still working on fully funding it. I am delayed while waiting to cash out my whole and variable life policies. When I cash them out, I'll experience an almost $10k hit in fees - bandits!! That will also lower my net worth, but at least I'll have better insurance and investment options.

The bulk of my cash savings is a high interest on-line money market account earning 4.5% at emigrant. The majority of the balance is in a local bank money market paying about 4%. The last bit is in a local checking account earning about 2% interest.

My immediate cash allocation plans are as follows (excluding liquidation proceeds from insurance):

- Rebuild operating cash reserve - I'd like to save about $24k more

- Test alternative short term cash investments like treasury bills and possibly short term municipal bonds (once interest rates stabilize)

- Incorporate more foreign investments into my ETF strategy, probly russia and india

- Consider loaning small amounts of money $50-$100 increments in an overall $2000 - $4000 portfolio in prosper.com.

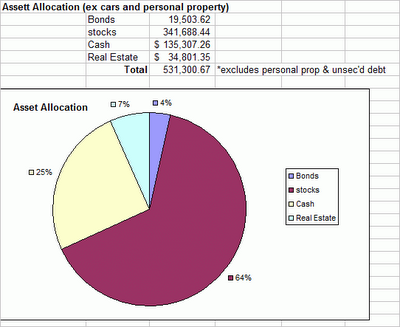

Here is my current allocation:

It's nice to be diversified with some additional asset clases - like real estate in this case.

Have a wonderful Monday,

makingourway

4 comments:

Cashing out your life policies now is probably the better of two evils. If they don't hit you now, they will hit you later. Either way you take a hit. Better to take the hit now and reinvest to proceeds then wait, have no proceeds to invest, and then get hit later. I agree with you they are bandits.

Good luck on your investing.

apollo,

thanks for endorsing the decision. my thinking is that the mutual funds wrapped into the variable policies are blanketing with extra administrative charges -- i bet i'm paying > 2% for the mutual fund fees, whereas a good ETF can be less than 3%.

regards,

makingourway

Any reason you have so much cash? Is/Was it in anticipatition of the new home purchase?

franky,

I keep a large cash reserve for several reasons:

1. psychological comfort

2. my income is exceedingly variable it can go from solid six figures down to zero very quickly

3. my wife also has a high but highly volatile income

4. we support other family memmbers

5. we live in a fairly rural area and if we needed to change jobs would have significant relocation expenses ($20k - $30k) on top of living expenses

6. our living expenses are fairly high, I'm estimating about $9500 per month, however, I'm going to research it and post a more precise number

7. our job positions are senior and may take 5-12 months to replace if lost, hence the need for about a year's worth of cash emergency money

franky,I hope this makes sense, if not, please let me know.

regards,

makingourway

Post a Comment