Here's a quick prosper update.

So far my borrowers are paying their loans, which is nice. I just won an excellent auction closing a AA credit borrower at 15%, for which I'm very pleased.

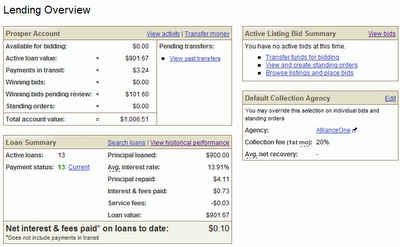

Here's my overall summary:

Here's a statement of my loand performance as of yesterday, my average interest rate was 13.84%.

Here's a statement of my loand performance as of yesterday, my average interest rate was 13.84%.

The loan auction I just won at 15% helped push up my average loan rate to 13.91%. Here it is:

Ultimately, most of my holdings are A and AA, with a few B and very few C grade borrowers. 13%+ rates are pretty difficult to maintain for such a heavily A weighted group, once my overall investment volume into prosper.com picks up, I may not be able to maintain such high rates.

I'd like to find or build a tool that would let me model risk return ratios for different lending mixes. Specifically 13.91% is not my risk adjusted return ration, it should be lower, maybe 11.91% or 12.91%. The math is much more complex than simply subtracting the average default rate.

Somehow I'm thinking I would be happiest with a 16% risk adjusted rate of return, however, I'm not certain what level of risk I'd need to assume.

Also, I should mention that I've lost a few auctions, which has been frustrating. But losing did have the beneficial effect of forcing me to evaluate new and alternative auctions that had just entered the market.

Regards,

makingourway

No comments:

Post a Comment