I was reading $2M's blog and found his posting on asset allocation a great idea.

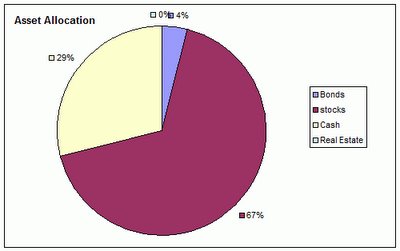

Here is my asset allocation (on a high level).

I'd like to include a more detailed investment allocation model, but need to figure out a cleaner way of extracting it from quicken.

Stocks - 67% of my investments are in stocks held in various retirement and brokerage accounts.

Bonds - 8.29% are in various bonds held by life cycle mutual funds in my retirement accounts. I generally don't hold bonds outside of my retirement accounts.

Cash - 29% represents a combination of operating cash, short term operating reserve and long term cash reserves. My long term cash reserves are at high interest MM providers like emigrant. My short term operating reserve is at a full service bank. It should earn about 4% in April. My operating accounts currently do not earn much interest 0.25% or so. I will move them to achieve about 2% per month.

Real Estate - 0% this will change when I start tracking my new house in quicken (probably later this month).

Request for comments

- What asset allocation do you have?

- Can you recommend any good discussions of asset allocation?

- Do you know of a tool for modeling predicted risk and returns of asset allocation (other than Quicken)?

Have a great Sunday,

Making Our Way

2 comments:

I've got some asset allocation model portfolio's posted on my blog site. It's not for everyone but it's one of many flavors.

Apollo,

I just visited your blog - it's great!

So much to read through. Certainly going to take a while before I get to the asset allocation discussions.

I did read the discussion on overseas indexes and want more!.

Good luck.

Making Our Way

Post a Comment